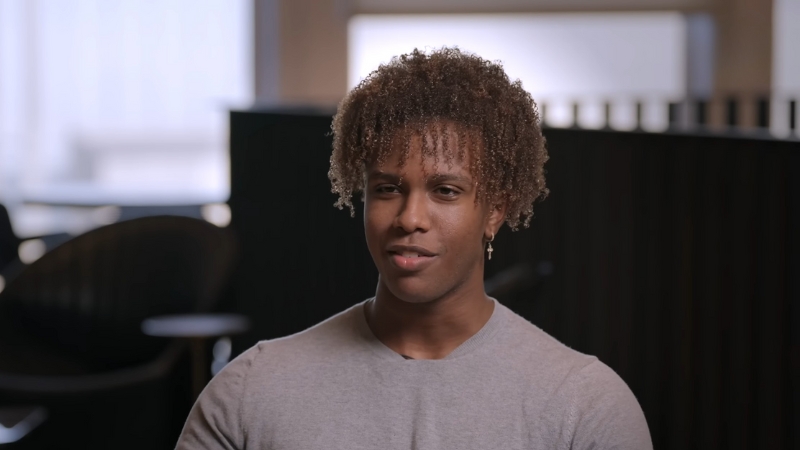

In early 2025, Nathaneo Johnson was not a typical college student. While most of his Yale classmates were buried in coursework and job applications, he was finalizing a $3.1 million pre-seed funding round for his startup, Series, an AI-driven platform built to make social networking more human.

That single event, a round closed in just 14 days, didn’t just give his company life; it redefined his personal financial trajectory.

By most reasonable estimates, Johnson’s net worth in 2025 sits somewhere between $1 million and $3 million, depending on how Series is currently valued. But that number tells only part of the story.

How Nathaneo Johnson Built Series

Before the Series, Johnson was already experimenting with technology in creative ways. In middle school, he built robots for school competitions. In high school, he designed an Arduino-powered assistive walking stick.

By the time he arrived at Yale, he was already collaborating with Sean Hargrow, who later became his co-founder.

The idea for Series was deceptively simple: modern social networks had lost their human touch. Johnson wanted to change that.

The series uses AI-integrated messaging tools that connect people directly through iMessage and SMS, creating meaningful, real introductions instead of passive likes or follows.

The $3.1 Million Pre-Seed That Changed Everything.

The fundraising round, completed in early 2025, was led by Anne Lee Skates (formerly of a16z, now at Parable VC) and joined by Pear VC and Reddit CEO Steve Huffman.

Closing a round that size in 14 days was remarkable, especially for a product still in early beta and run by full-time students.

Year

Funding Type

Amount Raised

Key Investors

2025

Pre-Seed

$3.1 million

Parable VC, Pear VC, Steve Huffman

The funding gave Series operational breathing room and positioned Johnson as one of the youngest founders with significant backing in the AI networking space. Overnight, he went from student innovator to venture-backed CEO.

Turning Capital Into Credibility

View this post on Instagram

Unlike many founders who celebrate a funding milestone with inflated spending, Johnson treated it as a starting point. According to Business Insider and AfroTech, he refused to take a salary in the early months, choosing to reinvest most of the funds into development, marketing, and AI optimization.

His decision reflects a broader trend in startup discipline, founders prioritizing sustainability and scalability over early personal gain.

Johnson’s approach aligns closely with investment frameworks promoted by firms like Ned Capital Recruitment, which emphasize operational efficiency and leadership talent in early-stage ventures.

That same mindset, build lean, prove value, then scale, is what has helped Series sustain early investor confidence.

What the Funding Means for His Net Worth

The $3.1 million raise didn’t instantly make Johnson wealthy. Instead, it created equity-based wealth, value tied to the performance of the series.

If the company’s pre-seed valuation sits around $15–20 million, and Johnson holds 10–15% equity, his paper wealth could easily exceed $2 million, depending on future dilution. However, this is not liquid wealth; most of it is locked in company shares.

Asset

Estimated Value (USD)

Liquidity

Notes

Series equity

$1.5–2.5 million

Illiquid

Based on the company valuation

Personal cash

<$500,000

Liquid

From small stipends, savings

Future options

TBD

Pending

Dependent on Series A terms

This distinction matters; Johnson’s financial position reflects potential, not guaranteed returns. If the Series continues scaling, that potential could compound rapidly.

Inside the Series Model

Series isn’t just another AI app. It’s designed as an AI-powered connection engine, a way to automate introductions through existing communication channels.

By focusing on real-world conversations instead of profile scrolling, it targets professionals and students who want real relationships instead of empty engagement.

The business model includes both free and paid tiers, with B2B subscriptions ranging between $200 and $550 per month for enterprises seeking intelligent lead generation and networking tools.

The company’s early traction, with more than 20,000 messages exchanged in its first week, demonstrates that its concept resonates with Gen Z and early-career professionals.

Why the Round Mattered Beyond Money

The $3.1 million raise did more than fund product development; it validated Johnson’s long-term strategic direction. With investors like Steve Huffman backing him, Series gained access to mentorship, credibility, and visibility across Silicon Valley and university entrepreneurship ecosystems.

But it also marked a symbolic shift: the rise of the student founder as a legitimate VC candidate. In previous decades, age was seen as a liability in venture circles. Now, youth often signal cultural fluency and fresh problem-solving perspectives.

Risks That Still Remain

No funding round guarantees success. The series still faces several critical challenges:

The next 12–18 months will determine whether Series can evolve from a promising prototype into a scalable business model.

The Broader Economic Context

@staytunednbc Two #Yale University students, Sean Hargrow and Nathaneo Johnson, raised $3.1 million for their #AI social network startup, “Series,” which connects students with like-minded individuals including friends, mentors, investors and more. The co-founders sat down with NBC News’ @Savannah Sellers to share what it took to get #Series ♬ original sound – staytunednbc

Johnson’s timing coincides with a wider movement in early-stage funding. In 2025, VC firms have shown renewed interest in AI-based productivity tools and connection software, driving pre-seed valuations upward by as much as 30% compared to 2023.

This environment favors agile founders who combine technical fluency with emotional intelligence, and Johnson fits that description. His team’s decision to use a humanoid robot CMO even demonstrated a nuanced understanding of media psychology, generating publicity without traditional ad spend.

The Bottom Line

Nathaneo Johnson’s net worth in 2025 isn’t about cash; it’s about leverage. His financial standing mirrors the current stage of the series itself: high potential, high responsibility, and high expectations.

The $3.1 million round transformed not just his personal finances but his professional credibility, giving him the resources to pursue a vision that merges human connection with machine intelligence.

If the Series continues to scale and secure future rounds, Johnson’s paper wealth could multiply severalfold. But for now, his real value lies not in liquidity, but in leadership, and in proving that a focused student founder can compete at the top of the AI startup economy.

Viola Moorhouse is the coauthor and research lead at Sharkalytics.com, specializing in startup performance tracking and investor strategy.

With a background in market research and business journalism, Viola focuses on separating the hype from the reality in the world of televised entrepreneurship. She’s passionate about making complex startup stories accessible to a wide audience.