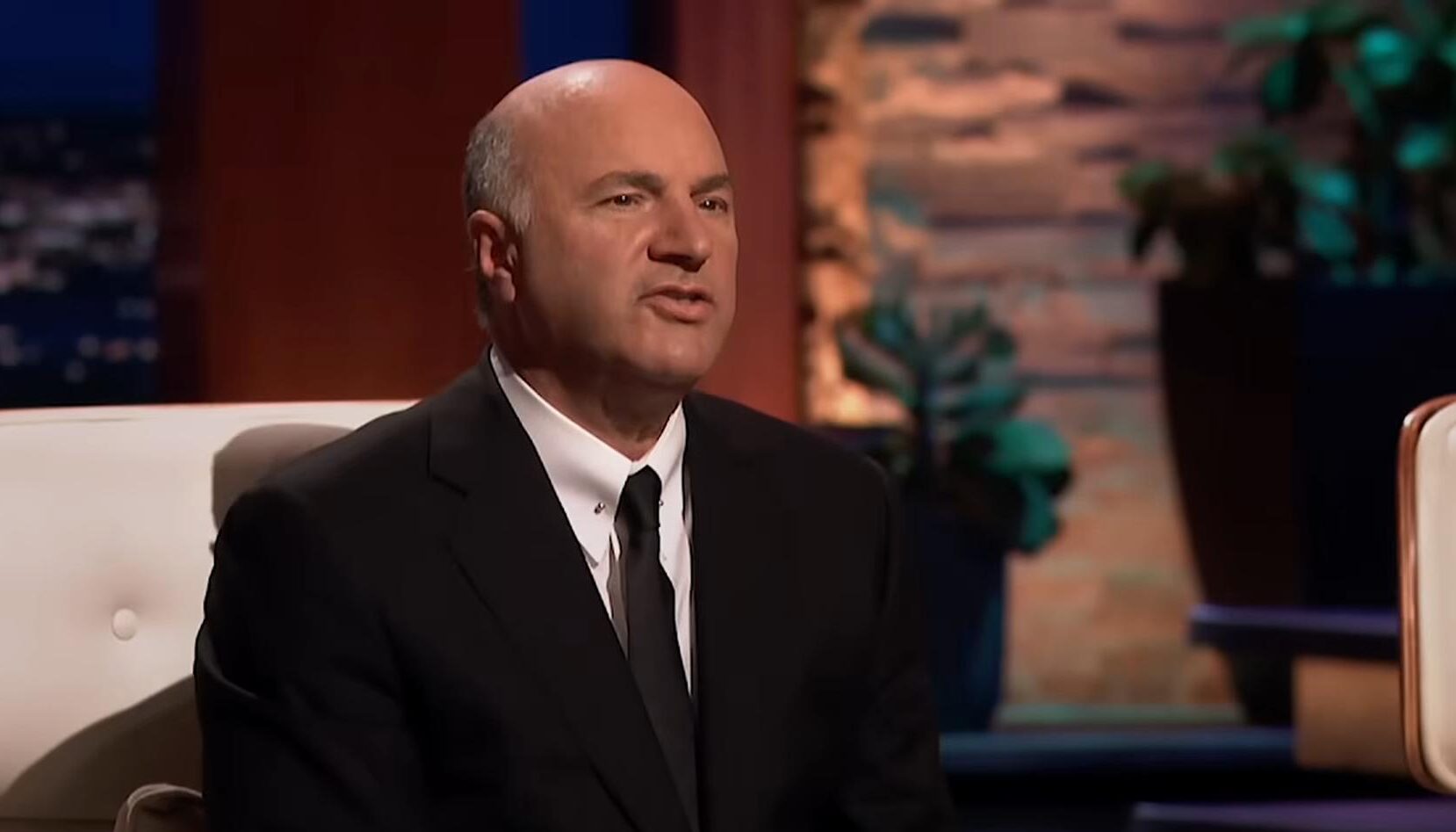

Kevin O’Leary, widely known as Mr. Wonderful, is a Canadian entrepreneur, author, and television personality recognized for his long-running role on Shark Tank.

His presence on the show spans 16 seasons and includes more than 40 completed deals with total on-air commitments exceeding $8.5 million.

A reputation for strict financial discipline and blunt feedback has shaped his on-screen persona and investor brand.

Focus on predictable cash flow and downside protection defines nearly every agreement he negotiates.

Kevin O’Leary’s Investment Philosophy

Kevin O’Leary’s reputation as an investor rests on discipline rather than optimism. Capital enters businesses with defined rules, clear timelines, and protection built into the structure.

Growth projections alone never justify a deal. Repayment visibility matters first, followed by profit participation only after initial risk has been reduced.

Cash generation sits at the center of every negotiation. Revenue that arrives consistently and predictably carries more weight than ambitious forecasts tied to distant exits.

Royalty arrangements appear repeatedly because they connect investor returns directly to product movement. Each unit sold works as a repayment mechanism rather than a promise of future valuation.

Capital efficiency also shapes decision-making. Companies capable of scaling without heavy staffing, large facilities, or complex supply chains receive priority.

Products designed for efficient manufacturing, simple logistics, and repeat purchases align best with this philosophy. Operational simplicity lowers risk and accelerates return.

Portfolio management follows the same logic. Exposure spans consumer products, food and beverage, technology, healthcare, and sustainability-driven solutions, yet volume remains controlled.

Oversight and performance discipline stay intact by limiting total holdings at any given time.

@wealth.ventures #kevinoleary explains his investment strategy and how he only ever buys stocks that pay him a dividend year in, year out. He explains in the last 40 years , 71% of market returns have come from dividends, not capital appreciation of a stocks value. You can use Top dividend stocks online to find the best dividend stocks to buy. By joining this website you can view reliable and accurate research to help you pick stocks that will grow your investment portfolio. Follow the link to see how it can help 📈 #dividend #dividends #dividendinvesting #stocks #stockstobuy #sharktank #foryou #foryoupage #fyp #mrwonderful #money #invest #investing #investingforbeginners #wealth #wealthy #wealthventures #compoundinterest #growthmindset #growth ♬ original sound – Wealth Ventures

- 30 to 40 active private companies

- Emphasis on short-term cash flow rather than long-term valuation bets

- Regular use of royalties as a repayment foundation

A quote often shared during deal discussions captures the mindset guiding these decisions:

“I don’t marry companies. I date them for 36 months, max.”

Most Successful Shark Tank Investments

Kevin O’Leary’s Shark Tank record includes dozens of deals, yet only a small number define his public success.

Outcomes tied to structure, timing, and repayment clarity separate strong investments from average ones. Royalty-driven agreements and selective equity plays illustrate how different tools perform under different conditions.

Wicked Good Cupcakes (2013)

Wicked Good Cupcakes marked a turning point in how royalty deals were perceived on Shark Tank. Risk reduction guided every element of the agreement.

Capital entered the business with repayment as the primary objective, followed by long-term income only after that goal was met.

- $75,000 invested

- $1 royalty per cupcake until repayment

- $0.45 royalty per cupcake in perpetuity

Sales results confirmed the logic. Revenue surpassed $10 million, and more than one million cupcakes reached consumers. Initial capital returned quickly, then ongoing royalty payments produced steady passive income.

Public conversation around Shark Tank often references this deal as a benchmark for royalty-based investing.

Basepaws (2019)

Basepaws arrived as a data-driven pet DNA testing company focused on genetic insights tied to animal health and traits. Strong acquisition potential shifted the deal structure toward equity rather than royalties.

The scalability of technology and buyer interest justified that decision.

- $125,000 invested

- 5% equity stake

- Acquisition valued at $50 million

Estimated personal proceeds for Kevin O’Leary reached roughly $2.5 million. He later described this outcome as his strongest percentage return on Shark Tank, reinforcing how selective equity positions can outperform royalties under favorable conditions.

Plated and Shutterfly

Participation in meal kit company Plated added exposure to a fast-growing food delivery segment. Albertsons later acquired Plated, creating indirect ownership tied to Shutterfly. Shutterfly eventually sold for tens of millions.

Disclosure restrictions limit exact figures. Available information still confirms a multi-million-dollar result driven by layered acquisitions rather than direct product royalties.

Notable Investments by Sector

Sector-based investing allows Kevin O’Leary to apply the same financial rules across different industries. Structure remains consistent even as products and markets change.

Technology and Innovation

Technology investments emphasize scalability, intellectual property, and contract-driven revenue.

PSYONIC secured a $1 million investment for 6% ownership during Season 15. Company operations focus on advanced bionic prosthetic limbs used by organizations such as NASA and Meta.

Chefee followed with a $500,000 agreement for 15% equity. Business development centers on robotic kitchen automation designed to improve efficiency in commercial food environments.

Cabinet Health combined equity and royalties through a $500,000 deal for 7% ownership. Product strategy targets environmentally conscious pharmaceutical packaging built around glass containers and compostable refill pouches.

View this post on Instagram

Food and Beverage

Food investments often rely on shelf stability, repeat consumption, and retail scalability. PhoLicious earned $500,000 for 15% equity during Season 16, positioning shelf-stable Vietnamese noodle soups for national distribution.

Tia Lupita Foods received a $500,000 line of credit instead of straight equity. Brand offerings focus on cactus-based tortilla chips aimed at health-conscious consumers.

Meat the Mushroom closed a $150,000 deal for 33.3% ownership. Product development centers on vegan meat alternatives produced using fungi and clean-label ingredients.

Consumer Products

Consumer goods deals prioritize simplicity and clear problem-solving. EyeWris secured $125,000 for 20% ownership tied to foldable wrist-worn reading glasses.

Poplight obtained $150,000 for 8% equity paired with a royalty structure. Product design supports renter-friendly lighting installation without wall damage.

The Dingle Dangle closed a $75,000 agreement for 20% ownership plus a $1 per-unit royalty. Product functionality combines play, sensory stimulation, and gifting convenience in one infant-focused item.

Health and Lifestyle

Health-focused investments often connect emotional value with structured repayment. AU Baby earned $80,000 for 35% ownership, centering on sustainable baby blankets designed with skincare considerations.

Parting Stone secured $400,000 for 10% equity and tiered royalties. Service offerings convert cremation remains into solid stone memorials, pairing craftsmanship with end-of-life services.

Chalkless closed a $400,000 agreement built around equity and royalties. Payment terms included a $2.50 royalty per unit until $4 million, followed by a $0.25 ongoing payment. Product design targets athletes seeking grip enhancement without chalk residue.

Deal Structure Patterns

Financial engineering anchors Kevin O’Leary’s deal making. Risk reduction guides structure choice before product enthusiasm enters the discussion. Royalty-first agreements dominate, ensuring capital recovery precedes profit sharing.

- Royalties until repayment, followed by reduced ongoing payments

- Equity tied to performance incentives and acquisition potential

- Loan and equity combinations for capital-intensive hardware businesses

RoboBurger demonstrates the hybrid model through a $1.5 million loan paired with 9% ownership tied to automated burger vending stations.

View this post on Instagram

Broader Business Context

Kevin O’Leary’s estimated net worth sits near $400 million, supported by multiple income channels. Business activity spans asset management, consumer brands, television, and speaking engagements.

O’Leary Funds gained recognition through dividend-focused investment strategies. Additional ventures include O’Leary Fine Wines and continued media appearances. Early financial success traces back to SoftKey Software Products, later acquired by Mattel for $4.2 billion in 1999.

Philanthropic efforts focus on practical impact, with ongoing support directed toward youth entrepreneurship programs, financial literacy education, and healthcare-related initiatives.

Summary

Kevin O’Leary’s Shark Tank record reflects a disciplined, return-driven investing style centered on structure and risk control.

Royalty mechanisms, strategic equity positions, and repayment-focused terms define his approach.

High-profile outcomes such as Basepaws and Wicked Good Cupcakes reinforce the effectiveness of that strategy.

Public visibility combined with consistent deal logic has secured his reputation as one of Shark Tank’s most financially successful investors.

Dave Mustaine is a business writer and startup analyst at Sharkalytics.com. His articles break down what happens after the cameras stop rolling, highlighting both big wins and behind-the-scenes challenges.

With a background in entrepreneurship and data analytics, Dave brings a sharp, practical lens to startup success and failure. When he’s not writing, he mentors founders and speaks at entrepreneur events.