Risk never waits politely outside the boardroom. It shows up inside pricing meetings, capital plans, cybersecurity reviews, supply chain calls, and market expansion debates. Leaders still have to choose a direction. Mathematical models sit right in the middle of that tension.

They turn uncertainty about outcomes, costs, timing, reputation, compliance, and survival into numbers leaders can challenge, compare, and act on.

Modeling will never erase uncertainty. What it does is force clarity about assumptions, expose sensitivity to key drivers, and connect risk appetite to choices like pricing, capital allocation, inventory policy, cybersecurity spend, and portfolio direction.

Strategy and risk analysis share the same core problem. Every decision already embeds a probability model, even when nobody says it out loud.

Risk Analysis And Strategy Share The Same Core Problem

Every strategic move assumes something about the future.

- Launch a product and there is an implied probability of adoption, churn, and pricing power.

- Enter a new market and there is an implied probability of regulatory friction and competitor response.

- Extend credit and there is an implied probability of default and recovery.

- Move workloads to the cloud and there is an implied probability of outage, breach, or vendor lock-in.

- Reshore a supply chain and there is an implied probability of disruption and demand shifts.

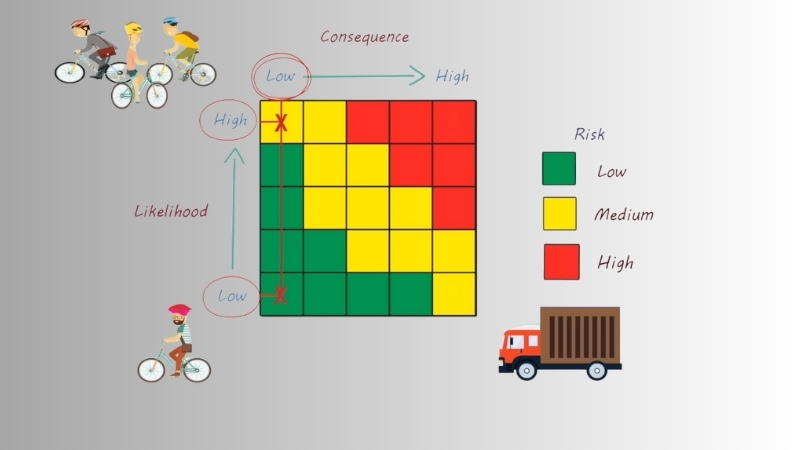

A practical risk model does three things that strategy teams actually care about.

- Quantifies exposure through expected loss, tail loss, downtime, earnings volatility, or capital impact.

- Explains drivers by showing which variables matter most and where dependencies hide.

- Supports decisions by letting leaders compare options under consistent assumptions, then choose.

Without modeling, those probabilities still exist. They just live inside intuition, politics, or PowerPoint certainty.

The Modeling Toolbox, Building Blocks That Show Up Everywhere

Every serious risk and strategy model, no matter how advanced it looks on paper, relies on a small set of foundational tools that appear again and again across industries and decisions.

Probability Distributions And Expected Value

Risk modeling starts with probability distributions because business outcomes are rarely single numbers.

Expected value acts as a first pass. It calculates the probability-weighted average outcome.

That approach works well for steady, repeatable decisions like routine pricing, standard underwriting, or inventory reorder points. It breaks down in high-impact, low-frequency settings where tail outcomes dominate the economics.

Expected value helps frame a conversation. It rarely settles it.

Understanding basic probability concepts, as you can with tutorials on Qui Si Risolve, strengthens the foundation for interpreting expected values and distributions in risk models.

Conditional Probability And Bayesian Updating

Real decisions evolve as new information arrives. Forecasts update. Fraud signals change. Competitors move. Regulation drafts leak before final publication.

Bayesian thinking formalizes that update cycle. A prior belief combines with new evidence to produce a posterior belief. That structure matters most when historical data is thin or regimes shift often, such as new product categories, emerging cyber threats, or climate-related shocks.

Teams using Bayesian logic tend to revise beliefs faster and argue less about whose forecast was right last quarter.

Time Series Models For Forecasting And Volatility

Revenue, costs, claims, price indices, and operational metrics often show trends, seasonality, and bursts of volatility. Time series methods help separate signal from noise and provide inputs for downstream risk models.

One common financial pattern is volatility clustering. Calm periods arrive, then turbulence follows. GARCH family models were built to capture that behavior and are often used as volatility inputs for Value at Risk calculations and related measures.

Time series models do not predict the future with certainty. They give structured expectations plus uncertainty bands, which is exactly what strategy needs.

Simulation And Monte Carlo Methods

Simulation becomes the workhorse once many uncertain inputs interact. Instead of calculating one outcome, Monte Carlo methods generate a distribution of outcomes by repeatedly sampling from input distributions.

A simple executive explanation works well here. Monte Carlo does not give the answer. It gives a range, plus likelihoods for outcomes inside that range. In risk analysis, the output usually looks like a distribution of possible costs, schedules, or financial results rather than a single point estimate.

That shift from point estimates to distributions changes how leaders talk about risk.

Optimization As A Strategy Engine

Once risk is measurable, optimization converts analysis into action.

In supply chain risk management, stochastic programming formalizes decisions that perform well across multiple plausible scenarios rather than optimizing for one forecast that rarely survives contact with reality.

Measuring Risk, Metrics That Connect To Business Decisions

A model becomes strategic only when its outputs influence real choices. Common outputs include:

- Expected loss as the average cost of risk over time.

- Earnings at risk or cash flow at risk as downside pressure on profitability or liquidity.

- VaR and Expected Shortfall as tail-oriented loss measures.

- Probability of breaching a covenant as a survival metric.

- Time to recovery as an operational resilience measure.

- Stress losses under scenarios for board and regulatory visibility.

VaR And Expected Shortfall In Market Risk

Value at Risk estimates a loss threshold at a chosen confidence level over a time horizon. Expected Shortfall estimates the average loss beyond that threshold and captures tail severity better than VaR.

Regulators moved toward Expected Shortfall for market risk capital in the Basel market risk framework. In Europe, implementation timelines have shifted, with public discussion of postponements tied to maintaining international consistency.

Outside banking, any business exposed to commodity prices, FX, or interest rates can use tail risk measures to set hedge ratios, pricing buffers, and risk limits with far more discipline than rule of thumb hedging.

Credit Risk Models, PD, LGD, EAD And Portfolio Loss

Credit risk modeling typically decomposes loss into three parts.

- PD as probability of default.

- LGD as loss given default, equal to one minus recovery rate.

- EAD as exposure at default.

Regulatory frameworks for internal ratings-based approaches spell out eligibility and minimum requirements for credit risk modeling and governance.

From a strategy lens, the benefits are practical.

Operational Risk, Frequency Severity And Extreme Losses

@playwithmathsbyj EXTREME VALUE THEOREM: Finding the Maximum and Minimum Values #calculus #basiccalculus #math #teachersoftiktok ♬ original sound – Play with Maths by J – PlayWithMathsbyJ | Math Tricks

Operational losses often follow a frequency-severity structure. Frequency may resemble a Poisson-like process. Severity often follows heavy-tailed distributions.

For extreme events, Extreme Value Theory focuses explicitly on tails. That approach fits catastrophic losses, large insurance claims, major outages, and rare operational disasters better than normal approximations.

From a strategy perspective:

- Control investments can be prioritized by the expected reduction in tail exposure.

- Insurance retention and limits can be evaluated against modeled tail losses.

- Business continuity plans can be sized around quantified downside rather than vague fear.

Cyber Risk, Combining Loss Quantification With Current Cost Realities

Cyber risk analysis often fails because it stays qualitative. A workable approach treats cyber loss as a distribution.

IBM’s Cost of a Data Breach Report 2025 reports a global average breach cost of $4.4M and describes its research base as 600 organizations impacted by breaches between March 2024 and February 2025.

Strategy links follow directly.

Expected annual loss can be estimated and compared to security program costs. Investments can be framed as reducing frequency through phishing resistance, MFA, and patching or reducing severity through segmentation, backups, and incident response readiness.

Scenario Analysis And Stress Testing, The Bridge To Board Decisions

Models can look precise and still miss reality when conditions shift. Scenario analysis counters that weakness by forcing coherent narratives.

In banking, supervisory stress tests project losses and capital under hypothetical adverse conditions. Regulators publish scenario descriptions and methodology documents, creating transparency around assumptions.

A concrete example appears in public reporting around the Federal Reserve’s 2025 stress test discussion, which referenced severe recession conditions, large declines in real estate prices, and spikes in unemployment cited in press coverage of the scenario release.

Outside banking, the same logic applies.

- Retail teams stress test pricing and demand under inflation spikes and consumer pullback.

- Manufacturers stress test supplier failure plus freight shocks plus FX swings.

- SaaS companies stress test churn and CAC under competitor price wars.

- Healthcare systems stress test staffing shortages and reimbursement shifts.

Scenarios turn abstract risk into stories leaders remember.

Modeling Dependencies, Where Risk Surprises Hide

Executives often see risk as a list. Losses usually arrive as a system.

- Supplier disruption raises costs, pushes prices up, and reduces demand.

- Credit defaults rise when unemployment spikes.

- Market risk correlations jump during crises.

- Cyber incidents trigger operational outages plus regulatory exposure plus reputational damage.

Correlation alone misses tail dependence and nonlinear relationships. Copula models exist largely to model dependence structures more flexibly, including tail dependence.

Strategic benefits follow.

Decision Models That Directly Support Strategy Choices

Decision models translate strategic uncertainty into structured choices, helping leaders compare options, clarify tradeoffs, and commit to actions with a clear view of risk and reward.

Decision Trees And Expected Value For Discrete Choices

Decision trees translate choices, chance events, and payoffs into a structured calculation using expected value at each decision node.

Educational materials often frame decision trees as a way to simplify complex business problems by combining probabilities and payoffs.

Strong use cases include:

- contract design decisions

- market entry sequencing

- product roadmap choices

- legal strategy under uncertain outcomes

Decision trees work best when choices are discrete and probabilities can be articulated clearly.

Real Options, Valuing Flexibility Under Uncertainty

View this post on Instagram

Standard discounted cash flow assumes a mostly fixed plan. Many strategic investments contain flexibility to expand, delay, abandon, switch inputs, or pivot markets.

Real options apply option logic to real assets and contingent decisions. Flexibility has value because managers decide after uncertainty unfolds rather than before.

Strong use cases include:

- phased product rollouts

- modular factories and capacity expansions

- R&D pipelines

- platform investments with uncertain adoption

Risk-Adjusted Optimization, CVaR and Robust Planning

When leadership prioritizes downside protection, Conditional Value at Risk style objectives become common. Optimization focuses on the average of the worst losses rather than average outcomes.

In supply chain planning, scenario-based stochastic optimization supports both risk-neutral and risk-averse planning under disruption propagation.

Model Risk Management, Preventing Spreadsheet Certainty

Models fail in predictable ways.

- Wrong assumptions

- Overfitting

- Data leakage

- Regime shifts

- Misuse outside the intended scope

- Weak documentation

- No independent challenge

US banking supervisory guidance defines model risk as adverse consequences from decisions based on incorrect or misused models and outlines expectations around development, validation, and governance.

Even outside regulated finance, the discipline transfers well.

- Define model purpose and limits.

- Document assumptions.

- Validate against holdout data.

- Run sensitivity tests.

- Back test tail metrics.

- Maintain change control.

- Assign accountability for use.

Governance does not slow strategy. It prevents false confidence.

A Practical Playbook, Building A Model Portfolio That Serves Strategy

List the decisions that actually matter.

Then define the risk metrics that influence those decisions.

Map Uncertainty Sources And Data Reality

Separate measurable variability like demand noise and delivery times from structural uncertainty like new regulations and competitor moves, plus deep uncertainty like rare systemic shocks.

Data quality matters more than model sophistication.

Choose Models That Match The Decision Horizon

- Short-horizon pricing and inventory benefit from time series and Monte Carlo methods.

- Medium-horizon investment decisions benefit from scenario analysis, decision trees, and real options.

- Long-horizon resilience planning benefits from stress tests, system dynamics, and robust optimization.

Build Transparency Into Output

Executives need distribution charts rather than single numbers, key driver rankings, scenario comparisons, and downside stories paired with numbers.

Treat Modeling As A Living System

Risk changes. Models need monitoring, recalibration, and periodic rebuilds. NIST’s AI Risk Management Framework describes risk management across the AI lifecycle and emphasizes periodic review as a core principle.

A Compact Model To Strategy Reference Table

| Model Family | Typical Output | Strong Use Cases | Data Needs | Common Pitfalls |

| Monte Carlo Simulation | Outcome distributions and probability of loss thresholds | Project cost risk, earnings volatility, cyber loss | Input distributions, correlations, drivers | False precision from weak inputs, ignored dependence |

| VaR And Expected Shortfall | Tail loss measures | Hedging, capital buffers, risk limits | Return histories, volatility estimates | Underestimated tail dependence, regime shifts |

| GARCH Volatility Models | Conditional volatility forecasts | Commodity and FX risk, option inputs | Time series returns | Overfitting, structural breaks |

| Extreme Value Theory | Tail quantiles and catastrophic loss metrics | Insurance, operational catastrophe | Extreme event samples | Sparse data, unstable tails |

| Copula Models | Joint distributions and tail dependence | Portfolio aggregation, systemic exposure | Marginal distributions and dependence | Wrong copula choice, calibration difficulty |

| Stochastic Programming | Optimal decisions under scenarios | Resilient supply chains, capacity planning | Scenario generation, constraints | Scenario blindness, computational burden |

| Decision Trees | Expected value of choices | Contracts, market entry | Probabilities and payoffs | Subjective probabilities, missing branches |

| Real Options | Value of flexibility | Staged investments, R&D | Volatility proxies, decision rules | Unrealistic exercise assumptions |

Closing Thoughts

Mathematical models do not replace judgment. They discipline it. They make assumptions visible, tradeoffs explicit, and risk appetite operational. In strategy, that clarity matters more than perfect forecasts.

Leaders who treat modeling as a living decision support system gain a quiet edge. They see the downside earlier, argue better, and place bets with eyes open.

Dave Mustaine is a business writer and startup analyst at Sharkalytics.com. His articles break down what happens after the cameras stop rolling, highlighting both big wins and behind-the-scenes challenges.

With a background in entrepreneurship and data analytics, Dave brings a sharp, practical lens to startup success and failure. When he’s not writing, he mentors founders and speaks at entrepreneur events.