Shark Tank has been on our screens since 2009, and it’s given many starry-eyed entrepreneurs a shot at fame, fortune, and maybe even a multimillion-dollar business.

It’s also introduced us to the drama of boardroom negotiations in front of a national audience. But the shining lights of TV can mask some pretty rocky roads that come afterward.

I’ve always been fascinated by those make-or-break moments right after the handshake deal on the show—because life post-Shark Tank can be a roller coaster of sudden demand, like Dragon’s Den, investor expectations, and cold-hard reality.

Some companies come out stronger, but a bunch of them don’t. Let’s explore a few that ended up shuttering, plus why they flatlined.

ToyGaroo

- Season & Episode: 2, Episode 2

- What They Did: Billed themselves as the “Netflix for toys.” Parents could rent toys (with free shipping) and then swap them out when their kids got bored.

The Deal

They scored $250,000 from Mark Cuban and Kevin O’Leary, which was a big chunk of change. On paper, it sounded revolutionary—why purchase expensive toys that kids outgrow, when you can just send them back?

The Fallout

As soon as ToyGaroo took off, their user numbers went through the roof. And guess what? That surge exposed a huge flaw: shipping costs soared because, well, toys come in all sizes and weights.

The free-shipping promise turned out to be an anchor dragging them under. Founders like Phil Smy mentioned that retailers like Walmart and ToysRUs weren’t exactly giving them magical discounts on products, so inventory and logistics ate up capital real quick.

The investors, for their part, apparently didn’t hook them up with the major toy connections they were hoping for. The pressure of explosive growth was overwhelming, and once the money started going out faster than it came in, it was game over.

Takeaway

Running out of cash is always a killer, but coupling that with a complicated shipping model turned it into a perfect storm. Startups need more than hype—they need a plan for all that growth.

Sweet Ballz

- Season & Episode: 5, Episode 1

- What They Did: Cake balls sold at convenience stores. The founders, James McDonald and Cole Egger, had racked up an impressive $700,000 in sales over just three months before they even went on the show.

The Deal

Mark Cuban and Barbara Corcoran invested $250,000 for a 25% equity stake. Given the early traction, it seemed like they’d scored a sweet opportunity (pun intended).

The Fallout

Shortly after their episode aired, McDonald and Egger got into a nasty legal battle. One of them started pushing a rival product called Cake Ballz, which basically led to an internal meltdown.

The fight spilled over into court, and all that publicity they garnered from the show went up in flames because they couldn’t capitalize on it. By the time the dust settled, the cake-ball craze had cooled down.

Instead of a steady climb, the business lost momentum. Though Sweet Ballz still technically operates as a side venture for McDonald, it never reached the heights many expected.

Takeaway

Investor cash can’t fix severe founder disagreements. If partners can’t align on the future (or if trust breaks), even a promising product can hit a dead end fast.

Body Jac

- Season & Episode: 1, Episode 5

- What They Did: A piece of fitness equipment meant to make push-ups easier, founded by “Cactus” Jack Barringer. It was pitched as a way to target muscle groups without the strain you might get from standard push-ups on the floor.

The Deal

They walked away with $180,000 from Kevin Harrington and Barbara Corcoran in exchange for half the company. That’s a big chunk of ownership, so the stakes were high.

The Fallout

They got a solid boost in early sales, but then the product seemed to vanish. The official site was pulled down in 2012, and Barbara Corcoran later went on record calling it her worst deal.

She hinted at production or consumer-demand issues, though exact details are fuzzy. Either way, it’s a big clue that Body Jac didn’t keep up with expectations.

Takeaway

Even a decent idea can fail if the market just isn’t there. Production difficulties, lack of long-term marketing, or plain old consumer disinterest can strike any product that isn’t prepared to adapt or expand.

CATEapp

- Season & Episode: 4, Episode 2

- What They Did: This was an app that hid calls and messages, supposedly aimed at boosting privacy. Neal Desai created it after buying the concept from a police officer for $17,500.

The Deal

They scored $70,000 for 35% of the company from Kevin O’Leary and Daymond John. It looked like a slam dunk for a digital product that could scale easily.

The Fallout

CATEapp snagged about 10,000 downloads soon after it appeared on TV, but there were ethical hiccups. The idea of hiding calls and texts raised eyebrows.

Plus, it was only available on Android at a time they claimed it was cross-platform. The hype fizzled, and by late 2014, the website was inactive.

Takeaway

Controversial products need bulletproof execution and a very clear target market. If people start feeling uneasy about the core offering, good luck sustaining growth.

Breathometer

View this post on Instagram

- Season & Episode: 5, Episode 2

- What They Did: A small breathalyzer that plugged into a smartphone. The pitch was that you could check your blood alcohol level anytime, anywhere. It raked in $138,000 from an Indiegogo campaign before hitting Shark Tank.

The Deal

All five Sharks joined forces to give founder Charles Michael Yim $1,000,000 for a 30% share. That was a rare moment on the show—securing backing from every single Shark.

The Fallout

Turns out, the device wasn’t very accurate. The Federal Trade Commission cracked down on it and demanded refunds for everyone, given the serious implications of a potentially inaccurate breathalyzer.

Meanwhile, Mark Cuban publicly criticized the founder for using the money on luxuries and not enough on actual R&D or product improvement.

Breathometer later pivoted to something called Mint, focusing on oral health, but that didn’t do any better in the long run.

Takeaway

Regulatory trouble and poor quality control will sink any product, especially one that claims to keep people safe. When you raise big bucks, you have to deliver on performance—or risk losing everything.

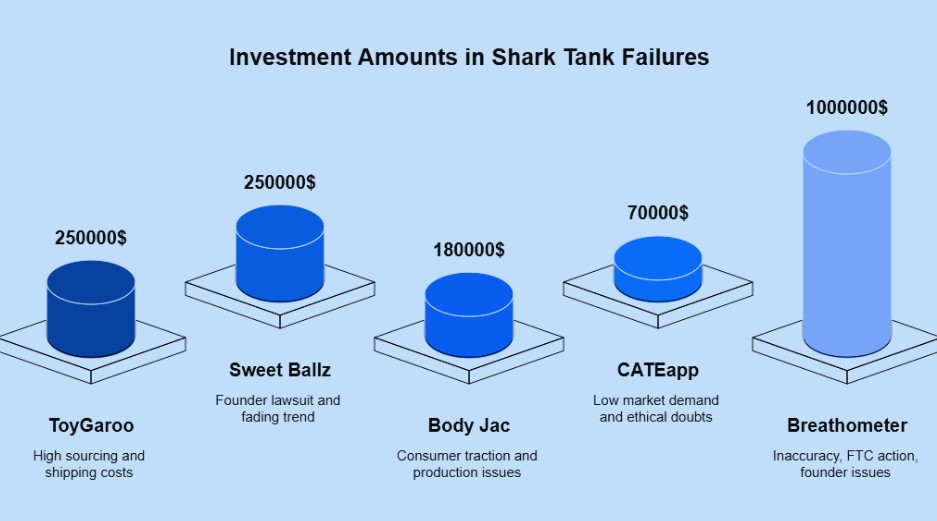

Statistical Snapshot

Now, one might think that Shark Tank sees a ton of flops, but that’s not actually the big picture. Between seasons 5 and 9, out of 210 companies, only around 12 officially tanked.

That’s a roughly 6% failure rate—much lower than the average business failure rate, which hovers around 70% if you track it far enough over time.

Here’s a quick look at some details:

Why These Busts Still Matter

Even though these stories highlight downfalls, they also offer serious insights. Over-expansion before locking down the logistics can easily kill a business (see ToyGaroo).

Personal disputes can tear apart a venture no matter how great the product seems (see Sweet Ballz). Shady or inaccurate claims will put the brakes on any momentum you’ve built (Breathometer).

And if consumers don’t truly want or trust your product, it won’t matter how much seed money you burn (CATEapp and Body Jac).

- Do your homework on supply chains and shipping costs. If you’re promising free shipping on bulky items, your bottom line might crumble fast.

- Choose your co-founders carefully. A little friction can be healthy, but a full-blown legal battle right after landing a big investment is deadly.

- Match product claims to actual performance. If you’re developing something in the health or safety space, double-check everything. Regulators can and will intervene.

- Don’t rely solely on hype. Even a ton of publicity from a reality show won’t compensate for shaky fundamentals.

Wrapping Up

Sometimes the story after Shark Tank is way more interesting than the one captured on camera. That final handshake can look like the ultimate dream come true, but it’s really just a starting point.

If the company isn’t structured well or the product can’t stand on its own, no amount of Shark star power will rescue it. Still, I don’t want to leave you feeling all doom and gloom. Shark Tank’s success stories absolutely exist.

But these particular companies show that even with an all-star investor lineup, a product can run straight into massive hurdles and sink. Business reality is tough like that.

Dave Mustaine is a business writer and startup analyst at Sharkalytics.com. His articles break down what happens after the cameras stop rolling, highlighting both big wins and behind-the-scenes challenges.

With a background in entrepreneurship and data analytics, Dave brings a sharp, practical lens to startup success and failure. When he’s not writing, he mentors founders and speaks at entrepreneur events.