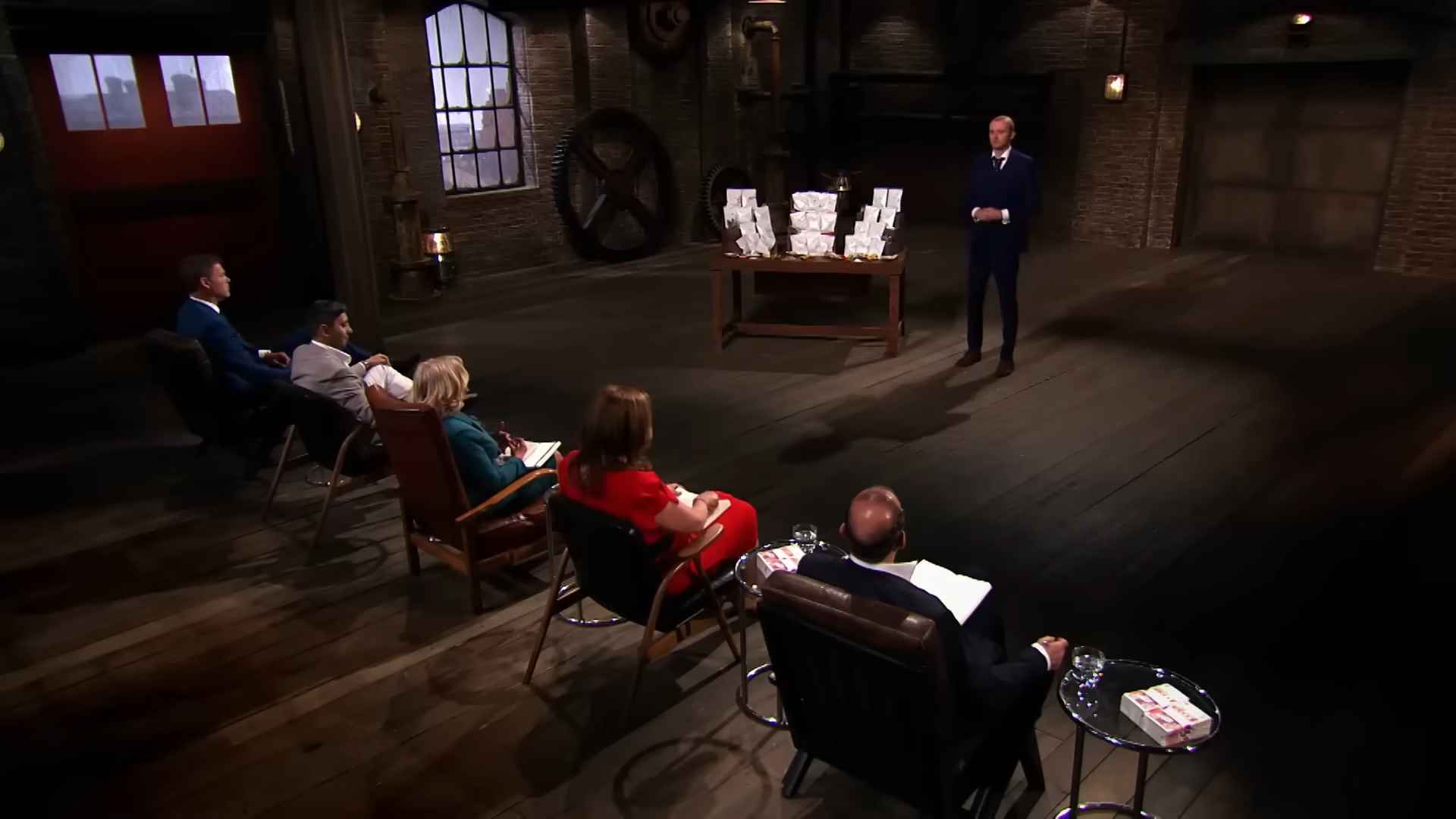

Dragons’ Den operates as a televised investment forum where entrepreneurs face seasoned investors while asking for capital in exchange for equity, just like Shark Tank.

Viewers often focus on dramatic negotiations, sharp critiques, and decisive moments.

Business outcomes after filming often matter far more than what happens under studio lights. Some pitches launched companies worth millions or billions, while others collapsed despite Dragon’s backing. Several rejected founders later built category leaders without any on-air deal.

A clear pattern emerges over time. Investment decisions made in minutes can shape years of growth, conflict, or reinvention.

Exposure can unlock opportunities that dwarf initial funding, while capital alone fails to rescue weak execution.

Biggest Success Stories

Long-term wins often share a common trait. Founders adapted after filming rather than clinging to original concepts. Capital mattered, yet strategic shifts mattered more.

Kirsty’s Ready Meals

Worthenshaws entered the Den in 2010, selling dairy-free ice cream. Peter Jones and Duncan Bannatyne invested £32.5K after spotting founder resilience more than product scale.

Kirsty Henshaw later redirected the company toward ready meals, unlocking a far larger addressable market. Valuation eventually reached £7.59M after the pivot, validating flexibility over fixation.

The Snaffling Pig Co.

@dragonsden.fans Will Peter Jones add Swine Snacks to his Pork-Folio? Part 1 #dragonsden #fyp ♬ original sound – DRAGONS’ DEN

Gourmet pork scratchings sounded niche during the pitch. Nick Jenkins invested £70K for 20 percent in 2016, betting on branding rather than novelty. Growth followed a deliberate premium positioning strategy supported by selective retail expansion.

Valuation later climbed to £11.4M, proving category size can expand with the right framing.

GripIt Fixings

Jordan Daykin arrived at age 18 with a plasterboard fixing solution aimed at tradespeople and DIY users. Deborah Meaden invested £80K for 25 percent after recognizing product clarity and founder drive. Growth followed real-world utility rather than hype.

- £23M valuation achieved

- £1.19M raised later through crowdfunding

Product simplicity paired with everyday demand fueled adoption across professional and consumer markets.

Gener8

Sam Jones pitched privacy-focused browser technology and secured £60K from Peter Jones. Gener8 later expanded into broader data control tools as public concern over digital privacy intensified.

Adoption accelerated alongside regulatory shifts and consumer awareness. Valuation eventually reached £36M as data ownership moved into mainstream discussion.

Biggest Misses

Some rejections aged poorly. Founders dismissed on set later built category leaders by leveraging exposure, conviction, and timing.

BrewDog

Founders failed to pass the initial screening and never pitched on air. Brand growth exploded anyway, driven by aggressive identity building and equity crowdfunding.

BrewDog later reached a £1.87B valuation after raising £320M, reshaping craft beer distribution globally. Early rejection preserved founder control during expansion.

Tangle Teezer

@globalsharktank The Famous Tangle Teezer Pitch #DragonsDen #sharktankglobal #tangleteezer ♬ Dragons Den_Now on YouTube – Shark Tank Global

Shaun Pulfrey asked for £80K in 2007 and left without a deal. Hair care differentiation proved stronger than Dragon skepticism.

Consumer adoption surged once distribution expanded. BIC later acquired the company for £165M, validating product focus over pitch performance.

HungryHouse

Dragons accepted a £150K deal for 50%, yet founders exited after filming. Exposure opened doors to larger capital pools.

External funding totaled £50M before acquisition by Just Eat for £200M. Founder conviction outweighed short-term certainty and reshaped outcome.

Gousto

Meal kits failed to persuade Dragons in 2013. Persistence and capital access later changed trajectory.

Several funding rounds followed, including £74M via SoftBank that briefly pushed valuation into unicorn territory. Profitability later replaced hypergrowth as the primary goal, stabilizing operations.

Ohyo

Aquatina’s collapsible bottle faced on-set ridicule, including physical dismissal of the product. Market response told a different story once broadcast aired.

- Over 100,000 units sold

- Distribution across more than 15 countries

- Licensing secured with Marks and Spencer

Public reaction overturned studio perception.

Oppo Ice Cream

@oppobrothers The Dragons didn’t bite 8 years ago. The rest is history 👀 we sat down with @BrewDog’s James Watt to discuss our Dragons’ Den experience. Link in bio to watch the full conversation 🍦 #dragonsden #sharktank #entrepreneur #icecream #brewdog #successstory #business #inspiring ♬ Powerful songs like action movie music – Tansa

A £60K pitch ended in rejection. Crowdfunding later raised £350K, attracting high-profile investors such as Andy Murray and Richard Branson.

Retail expansion followed, leading to placement in more than 1,300 UK supermarkets. Product timing aligned with rising demand for healthier desserts.

Trunki

@donnellycss Is this the most BRUTAL Dragon’s Den of all time? #dragonsden #react #entrepreneur #trunki ♬ original sound – Chris Donnelly

Ride-on suitcases failed to secure £100K in 2006 after a strap broke during demonstration.

Consumer demand persisted despite on-air skepticism. Sales exceeded £9.5M by 2018, driven by airport visibility and parent-to-parent advocacy.

Dragon-Backed Deals That Flopped

Capital and mentorship did not guarantee survival. Several funded companies collapsed due to limited scalability or weak demand persistence.

Foldio

@dragonsden.fans Part 1 | 19 Year Old Entrepreneur Shocks Dragons With Their Pitch #dragonsden #sharktank #uk #us #fyp ♬ original sound – DRAGONS’ DEN

Christian Lane secured £80K for 34 percent equity in 2007. Product relevance declined as consumer habits shifted and digital alternatives reduced demand.

Operations ended in 2015 despite early promise.

First Light Solutions

@dragonsden.fans Technology Entrepreneur Thinks His Company’s Worth £63M. Part 1 #dragonsden ♬ original sound – DRAGONS’ DEN

Marine safety technology using sonar attracted £100K for 30 percent equity. Technical capability failed to translate into widespread commercial adoption.

Closure followed six years later after slow sales cycles strained resources.

Gaming Alerts Limited

A casino and betting alert system raised £200K for 30 percent equity.

Regulatory complexity and thin differentiation eroded viability. Business folded in 2011, four years after investment.

Umbrolly

Advertising-supported umbrella vending generated interest, yet never finalized a deal. Capital shortages limited rollout while infrastructure costs climbed.

Operations shut down in 2010 after momentum stalled.

Anatomy of the Show

Dragons’ Den compresses years of business risk into a few televised minutes. Founders step onto the set with a prepared valuation, a funding request, and a proposed equity split, often shaped by months of rehearsal and forecasting.

Pressure escalates quickly as Dragons dissect assumptions and challenge confidence.

Dragons focus attention on a small set of core factors that tend to decide outcomes within minutes. Discussion usually circles several recurring pressure points, introduced early and revisited aggressively.

- Gross margins and long-term cost structure

- Scalability without founder dependency

- Ownership of intellectual property and freedom to operate

- Founder credibility under scrutiny

Negotiations rarely stay aligned with the opening ask. Valuations drop sharply, equity demands rise, or partners are added unexpectedly. Rejections often arrive abruptly once a single weakness undermines trust.

Verbal agreements reached on camera carry no binding force. Filming ends, due diligence begins, and reality often intervenes. More than half of accepted deals collapse after production wraps.

- Financial statements failing to match on-air claims

- Intellectual property owned by third parties or disputed founders

- Undisclosed debt, litigation, or supplier risk

- Founder’s reluctance to accept revised terms

Public exposure changes incentives. Some founders rethink equity concessions once investor outreach accelerates after the broadcast.

Others use visibility to secure partnerships, distribution, or funding offers that dwarf Dragon proposals. In many cases, airtime delivers greater value than capital.

Summary

Dragons’ Den produced billion-pound brands and highly visible failures.

Camera time can unlock growth or expose structural weakness.

Deals matter less than execution after filming ends. Lasting success depends on strategic decisions made once the studio lights fade.

Dave Mustaine is a business writer and startup analyst at Sharkalytics.com. His articles break down what happens after the cameras stop rolling, highlighting both big wins and behind-the-scenes challenges.

With a background in entrepreneurship and data analytics, Dave brings a sharp, practical lens to startup success and failure. When he’s not writing, he mentors founders and speaks at entrepreneur events.